Waste to Energy (WtE) Solutions For a Circular Waste Management System

Business Model Description

Invest in B2B models engaged in: > Scaled Waste to Energy (WtE) solutions using Refuse Derived Fuel (RDF) or Municipal Solid Waste (MSW) to produce energy through transformation facilities > Utilizing farm waste or municipal waste to generate electricity

KH09 Waste to Energy in Phnom Penh is a project by Global Green Growth Institute (GGGI) which started in 2019 (with a budget of USD 359,890) and was scheduled to end in 2021. Following a PPP design with a Build-Own-Operate-Transfer (BOOT) contract, its objective is to facilitate investment in a Refuse Derived Fuel (RDF) plant in Phnom Penh and replace coal with RDF for cement manufacturing. (10)

Mizuda Waste Management Co Ltd, founded in 1993, is a China based company that invested in a WtE plant in Siem Reap in 2020. The plant is capable of combusting 210,000 tons of rubbish per year into 12MW of electricity, resulting in generation of ~750,000 kilowatt-hours each year (accounting for ~10% Siem Reap’s current supply). (11)

MH Bio Energy Group Co., Ltd. (MH Bio), founded in 2006, is engaged in production of bio-ethanol. Apart from raising several private placement rounds (total amount raised till 2022 - USD 10 mn), MH Bio raised USD 25.2 mn for 80% of its stake sold to Seo Won Distribution Co., Ltd. (SWDC) in 2014, and currently operates as SWDC's subsidiary (MH Ethanol Co.,Ltd retains ~20% stake). (12)

Expected Impact

Improvement in waste management systems to ensure circular approach to managing waste; improvement in well being and positive environmental outcomes

How is this information gathered?

Investment opportunities with potential to contribute to sustainable development are based on country-level SDG Investor Maps.

Disclaimer

UNDP, the Private Finance for the SDGs, and their affiliates (collectively “UNDP”) do not seek or solicit investment for programmes, projects, or opportunities described on this site (collectively “Programmes”) or any other Programmes, and nothing on this page should constitute a solicitation for investment. The actors listed on this site are not partners of UNDP, and their inclusion should not be construed as an endorsement or recommendation by UNDP for any relationship or investment.

The descriptions on this page are provided for informational purposes only. Only companies and enterprises that appear under the case study tab have been validated and vetted through UNDP programmes such as the Growth Stage Impact Ventures (GSIV), Business Call to Action (BCtA), or through other UN agencies. Even then, under no circumstances should their appearance on this website be construed as an endorsement for any relationship or investment. UNDP assumes no liability for investment losses directly or indirectly resulting from recommendations made, implied, or inferred by its research. Likewise, UNDP assumes no claim to investment gains directly or indirectly resulting from trading profits, investment management, or advisory fees obtained by following investment recommendations made, implied, or inferred by its research.

Investment involves risk, and all investments should be made with the supervision of a professional investment manager or advisor. The materials on the website are not an offer to sell or a solicitation of an offer to buy any investment, security, or commodity, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Country & Regions

- Cambodia: Phnom Penh

- Cambodia : Kampot

- Cambodia: Siem Reap

Sector Classification

Infrastructure

Royal Government of Cambodia (RGC) estimates that ~8 mn people (>44%) will be living in urban areas by 2030 (1) [>4 mn people (>27%) reside in urban areas as of 2020 (2)]. TCdata360 ranked quality of Cambodia’s infrastructure as 99/137 in 2017, indicating a lack of housing, waste management and water treatment to support its growing population and urbanization. (3)

National Energy Efficiency Policy 2021-2030 aims to achieve the most efficient transformation of electricity consumption in Cambodia by creating a favorable environment for increasing investment opportunities in energy efficiency (4)

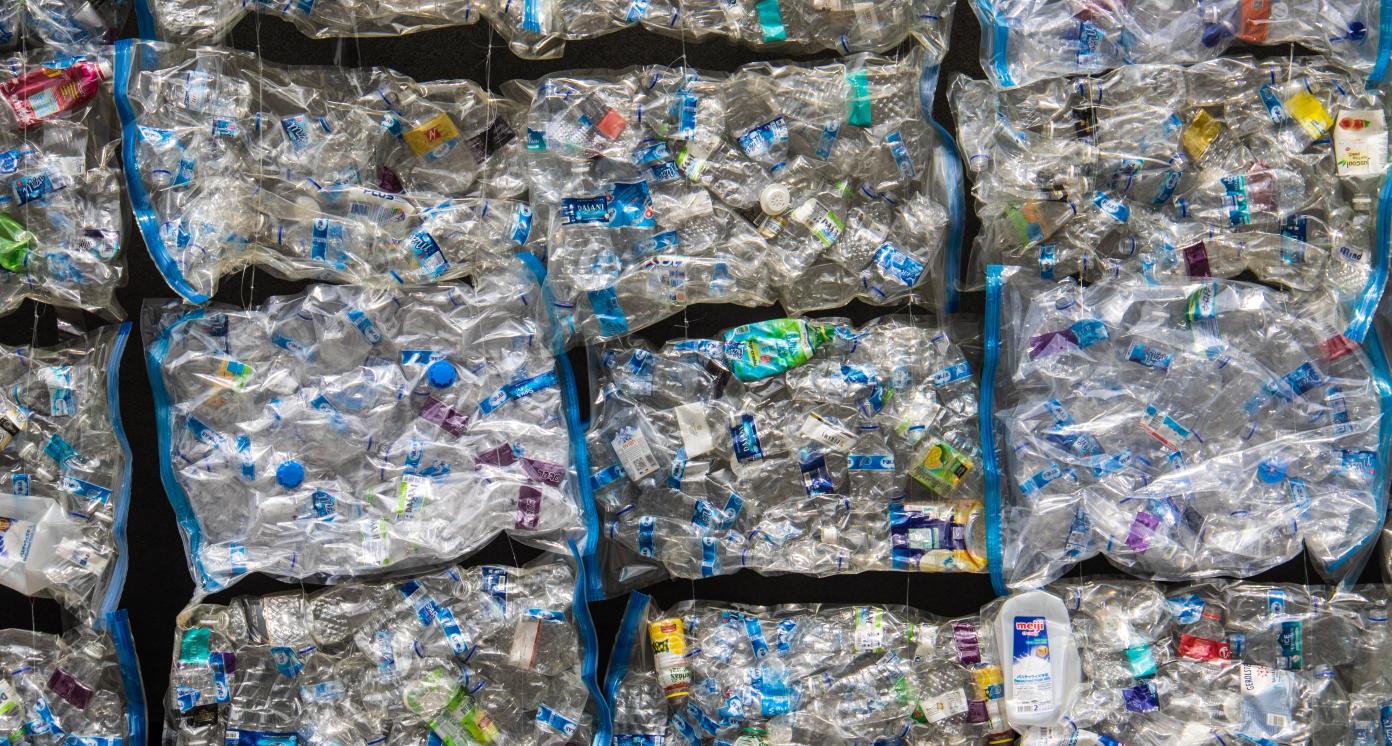

In Cambodia, burning waste is a common practice and an easy method of rubbish disposal, particularly in rural areas. This is due to a lack of dumpsites or waste collection services which lack proper separation of decaying and non-decaying wastes.

This has potentially negative health impacts (particularly for women waste collectors) due to reduced air quality, exposure to waste attracting vermin, polluted drinking water, and reduced soil fertility due to their proximity to dump sites.

While men occupy more jobs in areas such as construction work that are male dominated, the infrastructure of recyclable waste is dominated by a female workforce.

Most waste-pickers are women (‘ad chais’), who work 7 days a week, all round the year in exchange for daily wages. Most such women, typically from the poorest income groups, consider themselves too old to work at factories and work as a waste scavenger to support families. (5) (6)

RGC encourages private investment to bring in technical expertise and help fund the required infrastructure, particularly to extend utility provisions to new areas (especially rural areas or city-outskirts) under licensing arrangements (water connections, small scale power, water treatment plants).

Infrastructure in Cambodia is not only underdeveloped, but also underfunded. Upfront investment costs are significant and the current regulatory environment needs to introduce considerations that are conducive for private sector participation.

Waste Management

Growing urbanization and income, result in higher consumption and waste, which thereby poses a threat to health, environment, and climate. Waste generated in Phnom Penh increased >3x between 2007 and 2019 with generation of ~1 mn tons of waste [estimated to be 3.112 tons per day by 2030 (5)]. Inadequacy of the waste management system further aggravates the waste crisis in Cambodia. (7)

National Economic Strategy and Action Plan 2021-2035 related to waste management

Solid waste management system which relies on open-air burning, results in release of harmful chemicals with long term environmental and human health impacts. Due to a combination of socio-economic, cultural, and physiological factors, women, especially, pregnant women and their babies and girls are disproportionately vulnerable to the harmful impact of pollution from chemicals and waste.(8)

Waste pickers are particularly vulnerable to infections from microbes, that breed on solid waste disposed on city streets. (9)

Waste to fuel solutions to produce Refuse Derived Fuel (RDF) from mixed waste, can be used in the significant big cement manufacturing industry at relatively low capital expenditure (CAPEX), and substantial returns and volume. Smaller waste to energy solutions derived from Agri waste like husk or from factory waste to produce energy can also be applied.

Low collection and gate fees for waste and a lack of standardized Power Purchasing Agreements (PPAs) and Feed-in-Tariffs (FIT) prevent investment in traditional Waste to Energy (WtE) infrastructure (such as a standalone incinerator) as they require relatively high investment and standardized offtake arrangements.(10)

Waste Management

Pipeline Opportunity

Waste to Energy (WtE) Solutions For a Circular Waste Management System

Invest in B2B models engaged in: > Scaled Waste to Energy (WtE) solutions using Refuse Derived Fuel (RDF) or Municipal Solid Waste (MSW) to produce energy through transformation facilities > Utilizing farm waste or municipal waste to generate electricity

KH09 Waste to Energy in Phnom Penh is a project by Global Green Growth Institute (GGGI) which started in 2019 (with a budget of USD 359,890) and was scheduled to end in 2021. Following a PPP design with a Build-Own-Operate-Transfer (BOOT) contract, its objective is to facilitate investment in a Refuse Derived Fuel (RDF) plant in Phnom Penh and replace coal with RDF for cement manufacturing. (10)

Mizuda Waste Management Co Ltd, founded in 1993, is a China based company that invested in a WtE plant in Siem Reap in 2020. The plant is capable of combusting 210,000 tons of rubbish per year into 12MW of electricity, resulting in generation of ~750,000 kilowatt-hours each year (accounting for ~10% Siem Reap’s current supply). (11)

MH Bio Energy Group Co., Ltd. (MH Bio), founded in 2006, is engaged in production of bio-ethanol. Apart from raising several private placement rounds (total amount raised till 2022 - USD 10 mn), MH Bio raised USD 25.2 mn for 80% of its stake sold to Seo Won Distribution Co., Ltd. (SWDC) in 2014, and currently operates as SWDC's subsidiary (MH Ethanol Co.,Ltd retains ~20% stake). (12)

Business Case

Market Size and Environment

USD 100 million - USD 1 billion

In 2019, solid waste in dumpsites in Phnom Penh grew by 15% year-on-year (yoy) to 1.7 mn tons (14)

Total waste collected-~4 mn tons annually (15) Phnom Penh-2030 (expected):3.112 tons per day (5)

Of the 4 mn tons of waste produced annually in Cambodia (15) Household waste is ~55.3%, followed by hotels/guesthouses (16.7%), restaurants (13.8%), markets (7.5%), shops (5.4%) and offices (1.4%). Based on type of waste, ~51.9% is food and other organic waste, ~20.9% plastic and 9.9% is paper. (5)

Large projects (400,000-500,000 tons waste per year) can produce ~40MW of electricity. Even if this does not entirely solve the power issue, they can help reduce waste going into the landfill and generate a consistent, round the clock energy supply, unlike wind and solar power.(7)

In 2015, Global Environment Fund invested USD 7.5 mn in a regional 5-year project aiming to improve waste management in Cambodia (undertaken by the Ministry of Environment, the United Nations Industrial Development Organization (UNIDO) and Phnom Penh Municipal Hall), Philippines, Vietnam, Laos and Mongolia. It was implemented in Phnom Penh’s largest dumpsite, Choeung Ek.(5)

Indicative Return

10% - 15%

Expert consultations suggest WtE can generate returns similar to those in neighboring countries, i.e. 10-15%.

KH09 Waste to Energy (feasibility project) in Phnom Penh was initiated in 2019, with a budget of USD 359,890. However, the actual total expenditure as of Jan-Mar 2021 (Q1-2021) was USD 219,152. (10)

Investment Timeframe

Medium Term (5–10 years)

As per expert consultations, expected gestation period is ~5-10 years, depending upon the type of WtE project.

In 2014, MH Bio raised USD 25.2 mn for 80% stake sold to Seo Won Distribution Co., Ltd. (SWDC). (12) In 2019, MH Ethanol Co.,Ltd. announced an equity buyback of up to 100,000 shares, representing 12.99% of its issued share capital, for total worth of ~USD 501721 (implied equity value of USD 3.86 mn). (16)

Ticket Size

> USD 10 million

Market Risks & Scale Obstacles

Business - Business Model Unproven

Business - Business Model Unproven

Business - Supply Chain Constraints

Capital - CapEx Intensive

Business - Supply Chain Constraints

Business - Supply Chain Constraints

Impact Case

Sustainable Development Need

An efficient waste management system can ensure an improved quality of life for the population. 70-80% of waste ends up in landfills and ~20% is littered on the streets or in waterways, causing land and water pollution. Only ~10% of waste collected is suitable for recycling. (19)

An efficient waste management system can help in reversing climate change, which is a priority policy issue for RGC. Cambodia has submitted its NDC [Nationally Determined Contribution], the climate plan to the Climate Convention, where the waste sector is one of the areas of action.(7)

Responsibility for waste management systems must be clearly established. It is imperative to strengthen and delegate the responsibilities of sub-national governments on managing garbage and waste in their municipalities with clear roles, responsibilities and entry level incentives for private sector participation. (5)

Gender & Marginalisation

Adequately constructed dumpsites or waste collection services are required across all regions, particularly in rural areas where waste is disposed off by burning.(5) This results in a threat to human health, and disproportionately affects vulnerable people (waste pickers and people living near landfills).

Proper waste disposal systems can help ensure a clean living environment for the population, especially women and girls who are disproportionately vulnerable to the harmful impact of pollution from chemicals and waste.(8)

Measures must be taken to ensure protection of waste pickers and related staff who are particularly vulnerable to infections from microbes, bacteria, and viruses (including Covid-19) that breed on solid waste disposed on city streets. (9)

Expected Development Outcome

Increase energy efficiency and reduce Unintentionally Produced Persistent Organic Pollutants (UP-POPs) released through the application of appropriately selected technologies and fuels in the fossil fuel-fired utility and industrial boilers source category. (8)

Increase resource efficiency by increasing share of recovery and recycling in the waste disposal processes, and reduce waste generation through prevention, reduction, recycling and reuse.

Reduce Greenhouse Gas (GHG) emissions. Dangkor is the main landfill site, receiving ~808,530 tons of waste per year. ~59,715 tons of GHG are emitted from the landfill each year. (5)

Gender & Marginalisation

Reduce health risks, specifically impacting vulnerable people, by ensuring adequately constructed dumpsites, efficient waste collection, segregation and treatment processes.

Induce behavioral change in Cambodian people by creating awareness on reducing plastic usage and wastage, encourage recycling, especially in rural areas where the most common waste disposal mechanism is by burning. (5)

Uplift the quality of life of women engaged in waste-picking by applying improved methods of waste picking and segregation and ensure mobility of women into formal roles with commensurate wages.

Primary SDGs addressed

7.2.1 Renewable energy share in the total final energy consumption

Proportion of Renewable energy in the total final energy consumption is 3031.2 Mtoe in 2020. (20)

Proportion of Renewable energy in the total final energy consumption is 5066.2 Mtoe in 2030. (21)

11.6.1 Proportion of municipal solid waste collected and managed in controlled facilities out of total municipal waste generated, by cities

1.2 tons (2015) (21)

1.5 tons (2030) (21)

Secondary SDGs addressed

Directly impacted stakeholders

People

Gender inequality and/or marginalization

Planet

Corporates

Public sector

Indirectly impacted stakeholders

People

Gender inequality and/or marginalization

Planet

Corporates

Public sector

Outcome Risks

There is a risk of outcome failure if new waste treatment facilities and technology do not match the requirement of type and volume of waste generation in Cambodia.

Commensurate action to improve the quality of supportive infrastructure, energy development technologies, and capacity to implement the Industrial Development Policy 2015-2025 is required for fully realizing the potential of this Investment Opportunity Area.

In the absence of adequate efforts to build capacities of and educate households and businesses to segregate waste at source (households/businesses), the cost of segregation (time and money) will shift to the waste management company, thereby dis-incentivizing the growth of this business opportunity.

Gender inequality and/or marginalization risk: In the absence of regulations, the workforce participating in the waste management area, especially women, remain open to socio-economic exploitation hampering their social mobility and quality of life.

Impact Risks

Poorly fed WtE facilities may emit concentrated toxins with serious potential health risks, such as dioxins/furans and heavy metals negatively impacting people and the environment.

Reduced income generation opportunities for informal waste pickers, as a share of the waste is redirected to WtE facilities.

Gender/marginalization risk: Scaling up of businesses without adequate safety, capacity building and income security measures for waste picker communities can lead to further marginalization.

Impact Classification

What

Transforming waste to energy to resolve waste management and energy issues in Cambodia.

Who

Various; Population at large benefits from proper waste disposal and treatment; waste pickers benefit from improved livelihood; the planet benefits from a circular approach to waste management.

Risk

High set up and operational costs for WtE, compared to other energy sources, can hamper the growth of this area

Contribution

Large projects use 400,000-500,000 tons waste per year to produce ~40MW of electricity, and help in reducing the level of waste going into the landfill.(7)

How Much

Total waste collected was ~4 mn tons (15). In Phnom Penh waste generate is expected to be 3.112 tons per day by 2030 showing the potential for purposeful investments in the waste management space. (5)

Impact Thesis

Improvement in waste management systems to ensure circular approach to managing waste; improvement in well being and positive environmental outcomes

Enabling Environment

Policy Environment

Cambodia National Strategic Plan on Green Growth 2013-2030 aims to promote effective management of energy and renewable energy (4)

The Cambodia's updated NDC (2020) raises a number of important orientations, including climate change mitigation targets in the agriculture and waste sectors, and the country’s ambitious target for halving the deforestation rate by 2030. (7)

National Energy Efficiency Policy 2021-2030: aims to achieve the most efficient transformation of electricity consumption in Cambodia by creating a favorable environment for increasing investment opportunities in energy efficiency (8)

Financial Environment

Investment Law: Under article 24, green energy technology contributing to climate change adaptation and mitigation is entitled to investment incentives described under article 26 such as income tax exemption for 3 to 9 years, prepayment tax exemption, minimum tax exemption, among others. (24)

Investment Law: Under article 27, besides the basic incentives above, QIP will receive additional incentives such as VAT exemption for the purchase of locally made inputs, deduction of 150 % from tax base for activities such as research development and innovation. (24)

Regulatory Environment

Electricity Law, 2001: regulates power sector licensing and organizes a framework for electric supply and services throughout Cambodia. The law covers all activities related to the supply, the provision of services, and use of electricity, and other associated activities of the power sector. (22)

Sub decree on solid waste management regulates the solid waste management with proper technical manner and safe way in order to ensure the protection of human health and the conservation of bio-diversity (23)

Marketplace Participants

Private Sector

Corporates / Projects: KH09 Waste to Energy in Phnom Penh, KSWM Co.,Ltd, MH Bio Energy Group Co., Ltd., 800 Super, CINTRI, Global Action for Environment Awareness (GAEA) Investors: Mizuda Waste Management Co Ltd, SWITCH-Asia Others: Ashurst (world leader in WTE project implementation), SNV Cambodia

Government

Ministry of Environment, National Council for Sustainable Development, Ministry of Mines and Energy

Multilaterals

United Nations Development Programme, World Bank, Asian Development Bank, Gesellschaft für Internationale Zusammenarbeit (GIZ), United States Agency for International Development

Non-Profit

Energy Lab, Global Green Growth Institute, Cambodian Education and Waste Management Organization, Creal Cambodia, Youth Resource Development Program, Community Sanitation and Recycling Organization

Public-Private Partnership

Global Green Growth Institute (GGGI) Cambodia, Anti-plastic bags campaign (Ministry of Environment, Ministry of Tourism and Union of Youth Federations in Cambodia), Waste to Energy

Target Locations

Cambodia: Phnom Penh

Cambodia : Kampot

Cambodia: Siem Reap

References

- (1) Hin, P. (2018). Rising Demand for Cheap Housing. https://www.phnompenhpost.com/post-property/rising-demand-cheap-housing

- (2) World Bank. (2018). Urban Population--Cambodia. https://data.worldbank.org/indicator/SP.URB.TOTL?locations=KH

- (3) Business and Sustainable Development Commission. (2017). Better Business, Better World. https://sustainabledevelopment.un.org/content/documents/2399BetterBusinessBetterWorld.pdf

- (4) European Commission. (2020). National Energy and Climate Plans for 2021-2030 under the EU Energy Union. JRC122862/jrc122862_national_energy_and_climate_plans_under_the_eu_energy_union_governance_final.pdf

- (5) Open Development Cambodia. (2016). Solid Waste. https://opendevelopmentcambodia.net/topics/solid-waste/

- (6) Eitel, K. (2018). Veins of Phnom Penh: Urban Waste Pickers as the Best Infrastructure for Recycling Waste. https://kh.boell.org/en/2018/12/17/veins-phnom-penh-urban-waste-pickers-best-infrastructure-recycling-waste

- (7) Firn, M. (2021). Waste to Energy Projects Offer a Solution to Kingdom's Growign Garbage Problem. https://www.khmertimeskh.com/50976261/waste-to-energy-projects-offer-a-solution-to-kingdoms-growing-garbage-problem/

- (8) UNIDO. (2022). Cambodia Empowering Women in Waste Management. https://www.unido.org/green-industry-case-study-cambodia

- (9) Eitel, K. (2021). Oozing Matters: Infracycles of “Waste Management” and Emergent Naturecultures in Phnom Penh. East Asian Science, Technology and Society: An International Journal, 15:2, 135-152, DOI: 10.1080/18752160.2021.1896123

- (10) GGI. (2021). KH09 Waste to Energy in Phnom Penh. https://gggi.org/project/project-reference-profiles-cambodia-kh09-green-growth-government-waste-to-energy-in-phnom-penh/

- (11) Cambodia Construction Association. (2020). Chinese Firm to Build 12MW Waste-to-Energy Plant in Siem Reap. https://construction-property.com/chinese-firm-to-build-a-12mw-waste-to-energy-plant-in-siem-reap/

- (12) Market Screener. (2014). Seowon Distribution Co., Ltd. Agreed to Acquire 80% Stake in MH Bio Energy Group Co., Ltd. From MH Ethanol Co., Ltd. For KRW 40.3 Billion. https://www.marketscreener.com/quote/stock/MH-ETHANOL-CO-LTD-19180577/news/Seowon-Distribution-Co-Ltd-agreed-to-acquire-80-stake-in-MH-Bio-Energy-Group-Co-Ltd-from-MH-E-38842302/

- (13) WTE International. (2015). Cost of Incineration Plant. https://wteinternational.com/news/cost-of-incineration-plant/

- (14) Khmer Times. (2020). Waste-to-Energy Project in Phnom Penh Proposed. https://www.khmertimeskh.com/700938/waste-to-energy-project-in-phnom-penh-proposed/

- (15) World Bank. (2020). Cambodia: Solid Waste and Plastic Management Improvement Project. https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&cad=rja&uact=8&ved=2ahUKEwiWlcTbs7j2AhVMQ_UHHWYtAtcQFnoECAoQAQ&url=http%3A%2F%2Fdocuments1.worldbank.org%2Fcurated%2Fen%2F722141586260533194%2Fpdf%2FConcept-Project-Information-Document-PID-Cambodia-Solid-Waste-and-Plastic-Management-Improvement-Project-P170976.pdf&usg=AOvVaw1m-Swq5B6LwEBk1BkYRp8x

- (16) Market Screener. (2019). MH Ethanol Co.,Ltd. announces an Equity Buyback for 100,000 shares, representing 12.99% for KRW 635 million. https://www.marketscreener.com/quote/stock/MH-ETHANOL-CO-LTD-19180577/news/MH-Ethanol-Co-Ltd-announces-an-Equity-Buyback-for-100-000-shares-representing-12-99-for-KRW-635-34086661/

- (17) Ibid.

- (18) Thou, V. (2020). Chinese Company Eyes Waste-to-Power Plant in Siem Reap. https://www.phnompenhpost.com/business/chinese-company-eyes-waste-power-plant-siem-reap

- (19) Niem, C. (2021). City Hall Stiftens Waste Rules, But Cites Progress. https://www.phnompenhpost.com/national/city-hall-stiffens-waste-rules-cites-progress

- (20) Royal Government of Cambodia. (2019). Cambodia's Voluntary National Review 2019 on the Implementation of the 2030 Agenda for Sustainable Development. https://sustainabledevelopment.un.org/content/documents/23603Cambodia_VNR_SDPM_Approved.pdf

- (21) Royal Government of Cambodia. (2018). Cambodian Sustainable Development Goals (CSDGs) Framework (2016-2030). https://data.opendevelopmentmekong.net/dataset/3aacd312-3b1e-429c-ac1e-33b90949607d/resource/d340c835-e705-40a4-8fb3-66f957670072/download/csdg_framework_2016-2030_english_last_final-1.pdf

- (22) Royal Government of Cambodia. (2001). Electricity Law. https://cdc.gov.kh/wp-content/uploads/2022/04/LAW-ON-ELECTRICITY_010202-.pdf

- (23) Ministry of Environment. (1999). Sub-Decree on Solid Waste Management. http://www.wepa-db.net/policies/law/cambodia/03.htm#:~:text=The%20Sub%2DDecree%20regulates%20solid,health%20and%20to%20conserve%20biodiversity.

- (24) VDB. (2020). How are Power Projects Taxed in Cambodia. http://media.vdb-loi.com/wp-content/uploads/2020/04/How-Are-Power-Projects-Taxed-in-Cambodia_2.pdf